is insurance a unilateral contract

If the event does not happen then the company is not obligated to pay. In a unilateral contract there is an express offer that payment is made only by a partys performance.

Ppsc Lecturer Commerce Bs 17 Past Paper Original Paper Asan Mcqs Past Papers Lecture Commerce

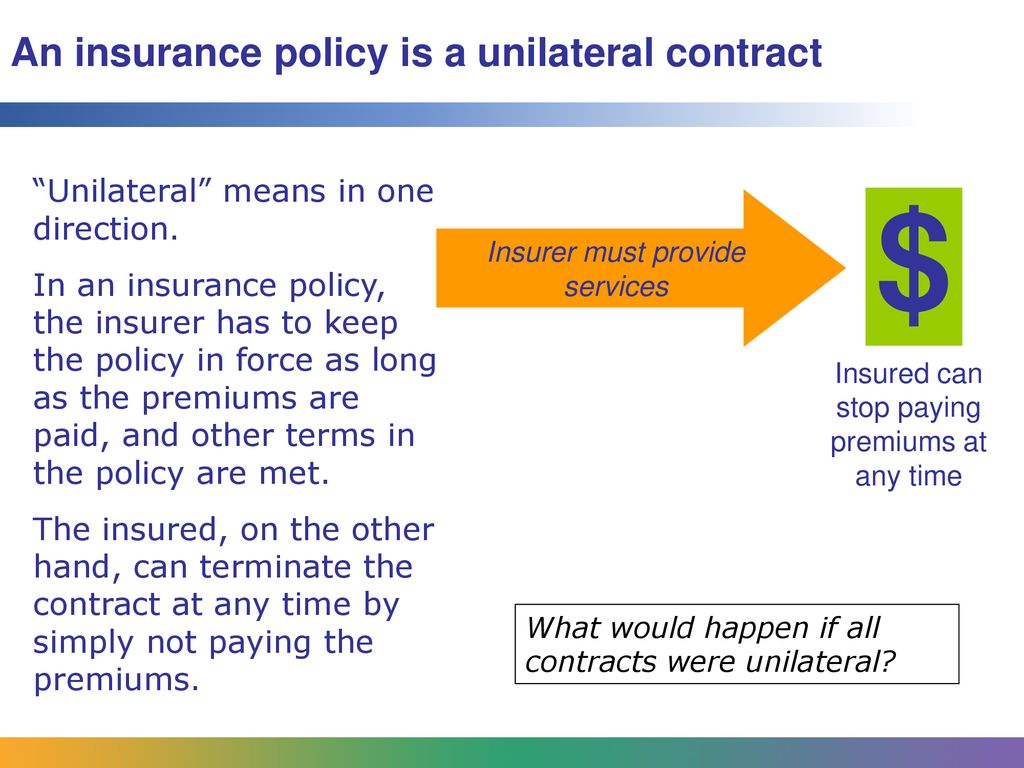

Insurance policies are usually unilateral agreements.

. Although the offeror is obligated to provide the. What is Unilateral contract. Typically the revocation needs to be express.

The other party doesnt have the same legal restrictions under the contract. Read on to discover the definition of the term Unilateral - to help you better understand the language used in insurance policies. In the case of a unilateral contract only the tenderer has an obligation.

A unilateral contract is a contract where only one person makes a promise. In a bilateral agreement both parties agree on an. The contract is deemed accepted when the offeree agrees to complete the requested task.

Here the insurance company promises to pay a specified sum of money only if the agreed-upon event occurs. A unilateral contract unlike the more common bilateral contract is a type of agreement where one party sometimes called the offeror makes an offer to a person organization or the general public. A unilateral contract refers to an agreement enforceable by the Indian Contract Law in which one party promisor promises to reward another party acceptor for performing a specific act.

Unilateral contracts are most commonly used when an offeror does have an open request for a specific activity for which they are willing to pay. Unilateral contracts rely on only one party to create a contract or promise for a specified or general group of people. By contrast the insured makes few if any enforceable promises to the insurer.

Unlike normal bilateral contracts for unilateral contracts the reward is not given in exchange for a promise from the other party. An insurance company makes a promise to pay for. For example a unilateral contract is enforceable when someone chooses to.

On the other hand bilateral contracts need at least two parties to negotiate agree and act upon a promise. A contract such as an insurance contract in which only one of the parties makes promises that are. In order for the offeree to receive whatever the offeror promises they need to perform the act or service that was requested in the.

A reward contract is a common unilateral contract that we see often in daily life. Another example of a unilateral contract can be an insurance contract. An insurance policy contract which is generally partially unilateral is an example of a.

Unilateral contract refers to a promise of one party to another that is legally binding. Both unilateral and bilateral contracts are enforceable in court. Insurance Auto Health Life Property Intentional Injuries Assault Bites Investments.

In a standard insurance contract the insurance company promises to provide coverage against losses while the insured does not make any promises. An insurance contract is a unilateral contract because the insurer promises coverage to the insured when the former recognizes the latter as an official policyholder. Insurance policies are one of the most common places to find characteristics of a unilateral contract.

In contract law for a contract to be considered unilateral it can only allow for one person to make the agreement. A contract in which only one party makes an enforceable promise. The insurance company promises it will pay the insured person a specific amount of money in case a certain event happens.

In exchange the insured promises to pay a small guaranteed payment called a premium. Only one party the offeror is. A prime example of a unilateral contract is that of insurance.

A unilateral contract is commonly formed in a number of cases. The unilateral insurance definition is an agreement on the part of insurance companies to pay. It is distinguished from a bilateral contract where there is a mutual exchange of promises each party to the contract makes a promise.

Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. By contrast the insured makes few if any enforceable promises to the insurer. An insurance agreement is a legal contract between an insurance company and an insured party.

Unilateral Contract a contract in which only one party makes an enforceable promise. In order for a unilateral contract to be considered legally enforceable the promise must be considered an offer and it must be. Simply put a unilateral contract is accepted after the action is completed while the bilateral contract is.

Distinguishing characteristic of an insurance contract in that it is only the insurance company that pledges anything. 673 660 of the Commercial Code Contracts can be unilateral or bilateral. Another example of a unilateral contract is a reward or a contest.

Search Quotes News Mutual. In a unilateral contract the offeror may revoke the offer before the offerees performance begins. Besides open requests insurance companies also use unilateral.

Another common example of a unilateral contract is with insurance contracts. A unilateral contract by definition is a contract that involves action taken by one group or one person alone. This contract allows the risk of a significant financial loss or burden to be transferred from the insured to the insurer.

Instead the insured must only fulfill certain conditions such as. Instead the insured must only. A unilateral contract is the one in which the offeror agrees to pay after the occurrence of a specific event.

Insurance can exist for virtually anything. Unilateral contracts are very different from bilateral contracts so this may be kind of a difficult concept to get the hang of so lets look at an example. Rather the insured simply pays a premium on the policy.

Since a property insurance contract is a personal contract it generally cannot be assigned to another party without the insurers consent. A unilateral contract or one-sided contract is one in which only one party the offeror agrees to reward the other party the offeree for performing an action. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims.

Appeal For Health Insurance Why Appeal For Health Insurance Had Been So Popular Till N Life And Health Insurance Health Insurance Companies Health Insurance

Insurance Contract Characteristics Traits Specific To Insurance Contracts Video Lesson Transcript Study Com

Engagement Letter Engagement Letter Letter Templates Lettering

Chapter 7 Insurance Contracts Contract Terminology A Contract

Unit 1 Lesson 4 Insurance Policy As Contract Ppt Download

Chapter 7 Insurance Contracts Contract Terminology A Contract

2 4 Long Duration Contracts Classification And Measurement

Pdf Doc Free Premium Templates Denial Letter Templates Letter Sample

Chapter 11 Insurance Contracts Ppt Download

Insurance 3 Insurance Contract And Insurance Companys Operations

Chapter 11 Insurance Contracts Ppt Download

Unilateral Contract Overview How It Works Examples

Chapter 11 Insurance Contracts Ppt Download

Rim Session 4 Features Of Insurance Contract And Principles Of Special Contract Of Insurance Youtube

Sample Demand For Child Support Payment Letter Templates Lettering Letter Sample

Unilateral Contract Definition Examples How It Works

Chapter 7 Insurance Contracts Contract Terminology A Contract

0 Response to "is insurance a unilateral contract"

Post a Comment